Another way banks use AI is to send mobile alerts to help prevent fraud

Abstract

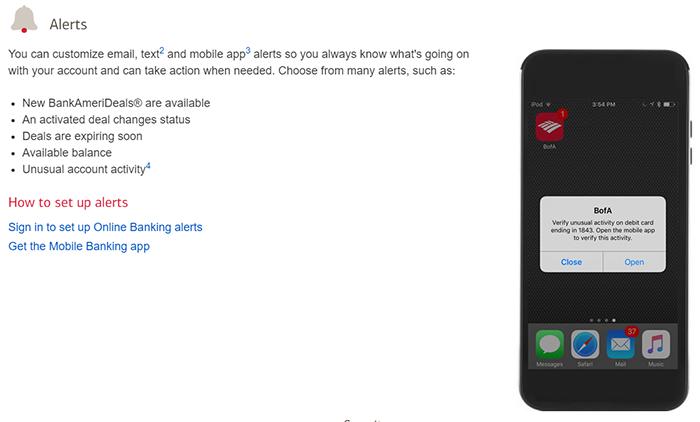

Another way banks use A I is to send mobile alerts to help prevent fraud.For example, if an unusually large transaction occurs on your account, you may receive a warning alert on your phone.Alternatively, if you suddenly start buying in another state, it may be marked as fraud prevention, requiring you to call the bank to verify the purchase in person.

By tracking your daily financial transactions, such notifications can be made, enabling AI to recognize abnormal patterns in your consumption habits.

Analysis

Inclusive finance means that a large number of ordinary people will be integrated into the financial system, and at the same time, the sinking of financial user groups also means that more customers may face or be exposed to security risks such as financial fraud.In the era of inclusive finance, the magnitude and level of financial data are far beyond users’ imagination. In the way of manual verification, the response speed and cost are far from meeting the needs of financial anti-fraud.The best way is to rely on big data and A I technical capabilities to quickly identify suspicious data from massive financial data, so as to achieve the three purposes of ensuring real users, submitting information, financial needs and use.Only on the premise of effectively preventing and controlling financial fraud, and reducing default and other financial risks, can the real implementation of the sustainable development goals of inclusive finance be promoted.

Pictures